Simplified estate planning tools for peace of mind

Anúncios

Simplified estate planning tools, such as wills and trusts, provide a straightforward way to manage your assets and ensure your wishes are honored without the complexity of traditional legal processes.

Simplified estate planning tools are essential for anyone looking to ensure their assets are organized and their wishes are respected. Have you thought about how these tools could make the process easier for you? Let’s dive in and explore the possibilities.

Anúncios

Understanding estate planning tools

Understanding estate planning tools is crucial for anyone wanting to protect their assets and ensure their wishes are honored. These tools simplify the complex process of estate planning by making it easier for you to outline how you want your affairs to be handled after your passing.

Several different types of estate planning tools exist, each serving its unique purpose. Familiarizing yourself with these tools can greatly ease the decision-making process.

Common Estate Planning Tools

There are several essential tools that are commonly used in estate planning. Each tool offers different benefits and should be considered based on individual needs.

- Wills: A will outlines how your assets should be distributed after your death. It can also name guardians for minors.

- Trusts: Trusts can help manage your assets during your life and dictate what happens to them after your death, often avoiding probate.

- Power of Attorney: This document allows someone to make decisions on your behalf if you become incapacitated.

- Healthcare Directive: Also known as a living will, this tool outlines your wishes regarding medical treatment in case you cannot communicate them.

Each of these tools has its unique advantages. For instance, using a trust can provide privacy and quicker asset distribution as it bypasses the probate process. A power of attorney ensures that someone can make critical decisions for you if you’re unable to do so.

Anúncios

Moreover, understanding how to effectively combine these tools can lead to an optimal estate plan. It’s vital to evaluate your personal situation and consult with a professional when necessary to find the right combination that aligns with your goals.

Estate planning may seem daunting, but having the right tools simplifies the process. By understanding estate planning tools, you can take control of your future and ensure that your wishes are fulfilled without unnecessary complications.

Benefits of using simplified tools

Using simplified estate planning tools offers many advantages that can make it easier for individuals to manage their estates. These tools reduce confusion and clarify important decisions regarding your assets and healthcare wishes.

One of the primary benefits is the time saved in the planning process. With straightforward tools, you can quickly outline your wishes without feeling overwhelmed by legal jargon. This accessibility makes it easier for everyone to engage in estate planning.

Key Advantages

Simplified tools streamline the planning process, providing numerous benefits. Here are some key advantages to consider:

- Cost-Effective: Simplified tools often cost less than traditional estate planning methods, making them an affordable option.

- Easy to Understand: They are typically written in plain language, making it easier for individuals to comprehend the necessary components.

- Quick Execution: These tools facilitate faster completion, allowing you to finalize your plans without unnecessary delays.

- Accessible Resources: Many of these tools are available online, ensuring widespread availability and convenience.

Furthermore, using simplified tools can foster communication among family members. When people understand the planning process, they are more likely to discuss their wishes with loved ones. This transparency helps prevent conflicts and confusion later on.

Another advantage is that simplified tools can adapt to changing circumstances. Life events such as marriage, divorce, or the birth of a child often necessitate updates to your estate plan. Simplified tools allow you to make these adjustments easily, ensuring your plan remains relevant.

In essence, simplified estate planning tools empower individuals to take control of their futures. These tools provide clarity, accessibility, and efficiency, enabling users to create a comprehensive estate plan that meets their specific needs.

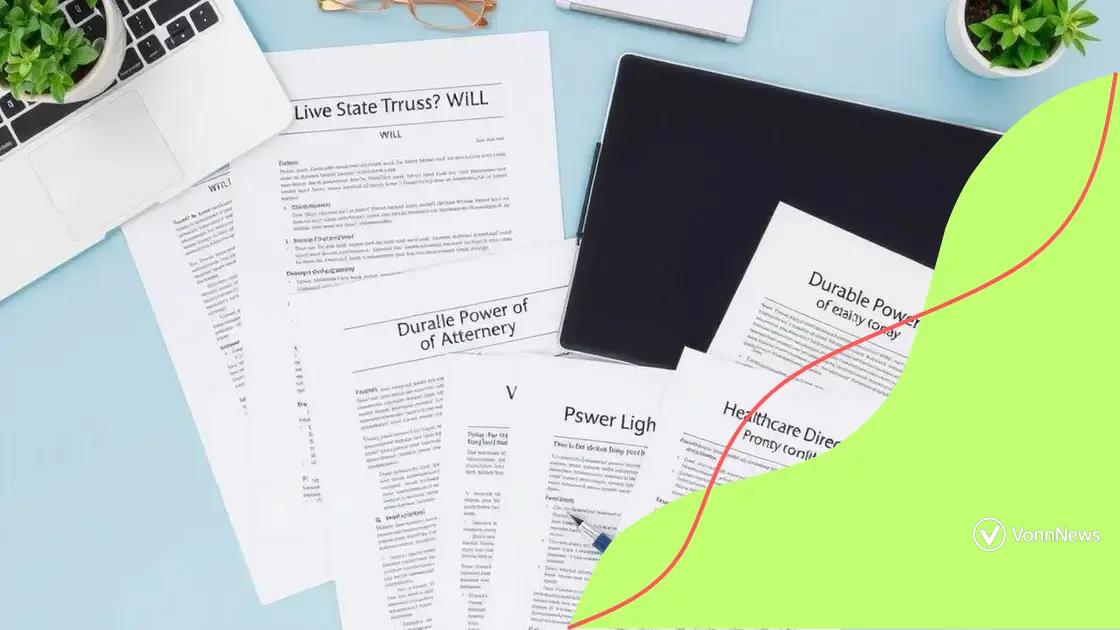

Common types of simplified estate planning tools

When exploring common types of simplified estate planning tools, it’s essential to recognize the variety available. These tools serve different purposes and can cater to unique needs, making planning more efficient and straightforward.

Some of the most frequently used tools are basic yet highly effective in facilitating the estate planning process. Understanding these options can help you choose what fits your situation best.

Types of Tools

Here are some common simplified estate planning tools that individuals can utilize:

- Wills: A will is a legal document that specifies how your assets will be distributed after your death. It can also designate guardians for minor children, giving you peace of mind.

- Living Trusts: This tool allows you to place your assets into a trust during your lifetime. A living trust can help avoid probate, making the transfer of assets more straightforward for your beneficiaries.

- Durable Power of Attorney: This document grants someone authority to make financial decisions on your behalf if you become incapacitated. It ensures that someone you trust can handle your affairs without delays.

- Healthcare Directives: Also known as living wills, these documents outline your medical care preferences if you are unable to communicate your wishes. They provide clarity to healthcare providers and family members alike.

Each of these tools has distinct advantages. For instance, a witnessed will is often easy to create and can be changed as your circumstances evolve. Meanwhile, a living trust can provide ongoing asset management while you are alive and can ease the burden on your heirs after your death.

Using these simplified tools can also facilitate conversation within families regarding estate planning decisions. When everyone understands the tools available, it fosters a more collaborative planning environment.

Ultimately, knowing about the common types of simplified estate planning tools can empower you to take charge of your future. These tools simplify complex legal processes, ensuring your wishes are fulfilled while making planning less daunting.

How to choose the right tool for you

Choosing the right estate planning tool can feel overwhelming, given the many options available. However, understanding your unique needs and circumstances can simplify the decision-making process significantly. Each tool serves different purposes and, when used correctly, can align with your estate planning goals.

It’s essential to consider what your specific objectives are before selecting a tool. For example, if you want to ensure your wishes are honored after death, a will may be the most straightforward choice. Alternatively, if avoiding probate is a priority, a living trust might be the better option.

Factors to Consider

When determining which tool fits your needs best, consider the following factors:

- Your Goals: Think about what you want to achieve. Are you mainly focused on how your assets will be distributed, or are there specific healthcare decisions you want to address?

- Complexity of Your Estate: If your estate is simple, a basic will may suffice. On the other hand, complex estates with numerous assets might benefit from a trust or power of attorney.

- Family Dynamics: Understanding your family structure and relationships can influence your choices. Are there potential conflicts, or do you have minor children needing guardianship?

- Legal Requirements: Different states have different laws regarding estate tools. Make sure any tool you choose aligns with local regulations.

Moreover, seeking professional advice can also be beneficial. Consulting with an estate planning attorney can provide personalized insight based on your situation. They can help clarify which tools are most effective for your needs and assist in drafting the necessary documents.

As you evaluate your options, remember that you can combine different tools. For instance, a will can work alongside a living trust, offering a comprehensive plan that covers various aspects of your estate. This flexibility allows you to create a system that accurately reflects your desires.

Ultimately, by actively considering your options and understanding the available tools, you can make a confident choice in your estate planning. Each decision impacts not just your future, but also the future of your loved ones.

Tips for effective estate planning with tools

Effective estate planning involves careful consideration and strategic use of available tools. By approaching your planning with a clear strategy, you can ensure your wishes are fulfilled. Here are some useful tips to enhance your estate planning experience.

One vital tip is to start planning early. Many people think estate planning is only for the elderly or wealthy, but unexpected events can happen at any age. Having a plan in place is essential for everyone.

Essential Tips for Effective Planning

Here are some important tips to keep in mind while using estate planning tools:

- Understand the tools: Take time to learn about different estate planning tools, like wills, trusts, and powers of attorney. Knowing what each tool does will help you choose the ones that fit your needs.

- Regularly update your plans: Your life changes, so should your estate plan. Review and update your documents regularly to reflect any major life events such as marriage, divorce, or the birth of a child.

- Communicate with your family: Talk to your loved ones about your estate plan. This communication helps avoid future conflicts and ensures everyone is aware of your wishes.

- Consult professionals: Don’t hesitate to seek help from an estate planning attorney or financial advisor. Professionals can guide you in making informed decisions and help you avoid common pitfalls.

Additionally, when creating documents, be as clear and specific as possible. Ambiguity can lead to misunderstandings among your heirs. Clearly defined terms and instructions will give your loved ones the guidance they need.

Using digital tools can also streamline your estate planning. Many online services offer templates and resources that are easy to use. However, ensure that these tools comply with your local laws and regulations.

Lastly, remember that your estate planning journey is unique. What works for someone else may not be ideal for you. Tailor your plan to fit your individual needs and objectives, ensuring peace of mind for you and your loved ones.

In conclusion, utilizing simplified estate planning tools can greatly enhance the way you manage your assets and ensure your wishes are respected. By understanding the tools available, regularly updating your plans, and communicating openly with loved ones, you can create a comprehensive estate plan tailored to your needs. Remember, taking action now can provide peace of mind for you and your family in the future.

FAQ – Frequently Asked Questions about Simplified Estate Planning Tools

What are simplified estate planning tools?

Simplified estate planning tools are legal documents like wills, trusts, and powers of attorney designed to make estate planning easier and more accessible.

Why is it important to start estate planning early?

Starting early ensures that your wishes are clearly documented and can reduce stress on loved ones during difficult times.

How can communication with family help my estate planning?

Discussing your estate plan with family can prevent misunderstandings and conflicts, ensuring everyone is on the same page regarding your wishes.

Do I need a lawyer to create my estate plan?

While it’s possible to use online tools, consulting a lawyer can provide personalized guidance and ensure compliance with local laws.